Do it WiselyWho We AreOur MissionWe believe in helping successful organizations, families and individuals maximize their financial impact for the people and causes that matter to them the most. We believe it is very important to give back to the community through both business and personal opportunities. Therefore, we are committed to serving clients that possess the same values. We believe in creating strong, long-term relationships by providing the utmost integrity in our practice. We provide our clients with innovative financial strategies by crystallizing their financial objectives, strategically protecting their assets, implementing tax minimization strategies, helping to maximize returns and alleviating portfolio volatility. Our Team

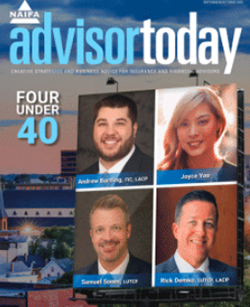

Joyce J. YooExecutive PartnerJoyce Yoo is the Executive Partner at Wisely Financial. From the start of her career, her focus has always been on building credibility through trust. With this as the foundation of her practice, she has passionately worked for 14 years to provide her clients with fully customized, personal, and need-based financial strategies for their future. Joyce is extremely honored to be recognized as a Forbes 2022 Top Ten Best in State Financial Securities Professionals for California and a 2020 Advisor Today’s national recipient of the Four Under Forty distinction. In addition, she is a Nautilus Plus member, which is a prestigious distinction of only 25 members of The Nautilus Group®, a highly selective, elite group of skilled advanced planning professionals. Joyce also considers it a great honor to be voted in by her fellow financial professionals as a 2022 Chair, 2023 Vice President and 2024 future President of the AAC, spending many hours volunteering to dialog with C-Suite Executives at various financial institutions to make enhancements to the way financial professionals do business. Joyce is also a 2022-2023 New York Life Chairman’s Cabinet member, making her part of the top 75 in a network of over 12,000 professionals. Her proudest accomplishment is her charitable giving, where she mainly focuses on volunteering and giving to children that are disadvantaged or have special needs. (CA Insurance Lic. #0H23562) OutreachLove Beyond The OrphanageWe volunteer for and support Love Beyond the Orphanage, a group that provides financial assistance to Korean orphans who must leave their orphanages because they are no longer eligible to receive governmental support after reaching the age of majority. Training Center for Church PlantersWe support Training Center for Church Planters in their efforts to provide aid in the form of medicine, food and basic supplies to hundreds of Ukrainians that have become refugees due to the war. World VisionWe volunteer for and support World Vision, a humanitarian organization that works with children, families and communities worldwide by taking on important issues such as poverty and injustice. They work in over 100 countries and provide emergency assistance to those affected by disasters and conflicts. We are proud to be a part of their Advisor’s Network. Hanna Orphan's Home (HOH)We volunteer for and support Hanna Orphan’s Home (HOH), a non-governmental organization that has helped orphans be self-sufficient in Ethiopia after unfortunate circumstances. Harmony OutreachWe volunteer for and support Harmony Outreach, an organization that works in China, Cambodia, Ethiopia and Vietnam in order to provide compassion work. Harmony Outreach has been active since 2001, and has helped establish orphanages and churches in the countries where they are active. St. Jude Children’s Research HospitalWe support St. Jude Children’s Research Hospital, an organization committed to leading the way the world understands, treats and defeats childhood cancer and other life-threatening diseases. At St. Judes, no child is denied treatment based on race, religion or a family's ability to pay. Muttville Senior Dog RescueWe support Muttville whose mission is to give senior dogs a second chance at life. Muttville rescues these dogs, gives them the care they need and finds them loving homes. Muttville has been recognized for its groundbreaking approach to animal rescue. Joyce J. Yoo

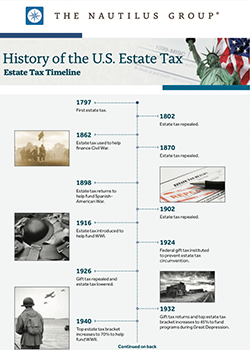

Joyce Yoo is the Executive Partner at Wisely Financial. From the start of her career, her focus has always been on building credibility through trust. With this as the foundation of her practice, she has passionately worked for 14 years to provide her clients with fully customized, personal, and need-based financial strategies for their future. Joyce is extremely honored to be recognized as a Forbes 2022 Top Ten Best in State Financial Securities Professionals for California and a 2020 Advisor Today’s national recipient of the Four Under Forty distinction. In addition, she is a Nautilus Plus member, which is a prestigious distinction of only 25 members of The Nautilus Group®, a highly selective, elite group of skilled advanced planning professionals. Joyce also considers it a great honor to be voted in by her fellow financial professionals as a 2022 Chair, 2023 Vice President and 2024 future President of the AAC, spending many hours volunteering to dialog with C-Suite Executives at various financial institution to make enhancements to the way financial professionals do business. Joyce is also a 2022-2023 New York Life Chairman’s Cabinet member1, making her part of the top 75 in a network of over 12,000 professionals. Her proudest accomplishment is her charitable giving, where she mainly focuses on volunteering and giving to children that are disadvantaged or have special needs. (CA Insurance Lic. #0H23562) 1Council is an annual company recognition program based on agent production from July 1-June 30. Neither SHOOK nor Forbes receives any compensation in exchange for placement on its Top Financial Security Professional (FSP) rankings (including the Best-In-State Financial Security Professional rankings), which are determined independently (see methodology). FSP refers to professionals who are properly licensed to sell life insurance and annuities. FSPs may also hold other credentials and licenses which would allow them to offer investments and securities products through those licenses. The ranking algorithm is based on qualitative measures learned through telephone, virtual and in-person interviews to measure best practices, client retention, industry experience, credentials, review of compliance records, firm nominations; and quantitative criteria, such as assets under management, sales figures, and revenue generated for their firms. Investment performance is not a criterion because client objectives and risk tolerances vary, and these professionals rarely have audited performance reports. Individuals must carefully choose the right FSP for their own situation and perform their own due diligence. SHOOK’s research and rankings provide opinions intended to help individuals choose the right FSP and are not indicative of future performance or representative of any one client’s experience. Past performance is not an indication of future results. For more information, please see www.SHOOKresearch.com. SHOOK is a registered trademark of SHOOK Research, LLC. Eagle Strategies LLCThrough Eagle Strategies, Joyce J. Yoo provides fee-based financial planning, investment advisory services, and access to investment management programs. Eagle Strategies LLC is registered with the Securities and Exchange Commission as an "Investment Adviser" and is an indirect, wholly owned subsidiary of New York Life Insurance Company. What We DoBusiness SolutionsThe Wisely team offers a wide array of services to help companies address their financial needs at every stage of the business life cycle, taking into account their company values and financial goals. Our open architecture approach personalizes the process and customizes plans to help businesses meet their objectives. Click on some of our key services below for more details. Deferred CompensationDeferred compensation is a written agreement between an employer and an employee where the employee chooses to have part of his or her compensation withheld by the company, invested on their behalf, and distributed back to them at a pre-determined point in the future. Deferred compensation can be used as a flexible way to attract and incentivize key employees. Executive BenefitsThe success of most businesses is tied into the talent, passion and work ethics of their key executives. Executive benefit packages can help you attract, motivate, and retain high-caliber employees and keep your company healthy and stable. We can help you with non-qualified plans, supplemental employee retirement plans, split dollar plans, and more. Buy-Sell AgreementsA buy–sell agreement is a legally binding agreement between co-owners of a business that governs the situation if a co-owner leaves the business, dies or is no longer able to function in his or her role, whether by force or by choice. A funded buy-sell plan utilizes business tools to ensure that the arrangement is properly financed so that there will be money when an event is triggered. Succession PlanningSuccession planning allows business owners to leave their business on their own timeframe while preparing their company to be transferred to family members, key employees, an outside party, or even a charity. This must be done in a way that achieves personal financial security, maintains harmony, and achieves maximum value for the business. Key Person InsuranceKey person life insurance offers a death benefit that indemnifies an employer for the loss of one of its most important assets - the key person. This can help assure continuity of the business for employees, customers and creditors, and protects against losses in sales, momentum, and credit. It can also be used to recruit and develop a replacement for the employee. Investment AdvisoryWe understand that your financial needs are unique. That is why we work with you to build customized solutions based on your goals, risk tolerance, tax exposure and investment time horizon. Through careful planning and advisory, we select investments, tailored to meet your unique circumstances. All investment advisory services are offered through Eagle Strategies LLC, a registered investment adviser. All investments involve risk, including the potential loss of principal. Group BenefitsThe benefits you offer are an important part of how you attract, retain and reward great employees. We can help you customized the right package that includes executive and deferred compensation plans, group life and disability insurance, etc. Personal SolutionsThe Wisely team provides individuals and families with innovative, cutting-edge services to help them grow, protect and conserve their wealth through all stages in life. Taking into account your needs, goals and tolerance to risk, we will work with you to bring clarity to where you are going and how to get there. Click on some of our key services below for more details. Fund AllocationAt your instruction, we allocate your mutual funds by implementing an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each fund in an investment portfolio according to your personal risk tolerance, goals and investment time frame. The focus is on the characteristics of the overall portfolio. Estate PlanningA well-engineered estate conservation plan can minimize tax liability and ensure that loved ones are protected. We will work with you and your other advisors to assess the impact of state and federal taxes on your estate and suggest strategies to help minimize those taxes, all while meeting your personal philosophies and family needs. Asset ProtectionThere are numerous financial strategies and retirement income plans that can help you accumulate assets for the future, shield your personal assets from liabilities, and safeguard asset transfer to children and grandchildren. We can help you figure out the right course of action, tailored to your specific situation and objectives. Charitable PlanningCharitable planning allows you to support the organizations and causes that matter to you, while maintain your financial security and reducing your tax burden. Numerous charitable giving strategies exist, and we can help you design and execute a charitable giving plan that is in alignment with your personal and philanthropic goals. Please seek tax advice from your own tax advisors. RolloversWhen you leave a job or retire, you have a decision to make regarding your company retirement money. While leaving those assets in the former employer’s plan is an option, a rollover should be a consideration. Working with your tax advisor, we can help you determine the right course of action for you. This may include: leaving the funds in your existing plan, if permitted, or rolling them into your new employer's plan, if one is available and rollovers are permitted. Each choice offers advantages and disadvantages, depending on your specific needs and retirement plan, such as the desired investment options and services, applicable fees, expenses, and withdrawal options, as well as required minimum distributions and tax treatment of applicable options. Neither New York Life Insurance Company nor its agents offer tax advice. Disability and Extended Care NeedsTo execute a sound retirement strategy, asset and income protection are a must. Designing a plan that encompasses managing costs for extended periods of care and disability insurance can help create the necessary balance in a portfolio to ensure stability and protection of assets. Products available through one or more carriers not affiliated with New York Life Insurance Company, dependent on carrier authorization and product availability in your state or locality. Investment advisoryWe understand that your financial needs are unique. That is why we work with you to build customized solutions based on your goals, risk tolerance, tax exposure and investment time horizon. Through careful planning and advisory, we select investments, tailored to meet your unique circumstances. All investment advisory services are offered through Eagle Strategies LLC, a registered investment adviser. All investments involve risk, including the potential loss of principal. Financial PlanningWe provide personalized financial planning to our clients that is specific to several variables including taxation, risk tolerance, income, net worth and values. We work with each client to identify and prioritize their goals, explore options, establish effective strategies, construct and execute a plan, and assess the performance of the plan and make adjustments as needed. Our ProcessOur process begins with understanding the concerns that are most important to you. From there, we formulate the right course of action specifically tailored to your needs. Our Six Step Process

|

Wisely Financial Strategies | San Francisco, CA

New York Life

Contact Us

425 Market Street Suite 1600

San Francisco, CA 94105

- E-mail address: jjyoo@ft.nyl.com

Do it Wisely |

Wisely Financial Strategies | San Francisco, CA

New York Life

Contact Us

425 Market Street Suite 1600

San Francisco, CA 94105

- E-mail address: jjyoo@ft.nyl.com